Millennials are a key and growing segment in the payments industry, with unique and high expectations for customer service. To be competitive in attracting and retaining this important customer segment, issuers should focus on understanding and addressing their service needs.

In Marketing credit and debit to millennials part one, we discussed how this segment transitions to using credit, selects credit products based on fees and offers, and is concerned with building credit, among other topics.

Here we'll discuss how millennials expect a seamless, omnichannel experience, are vocal when their needs and expectations aren’t met—and the solutions we offer to help you provide great customer service.

Service needs and expectations

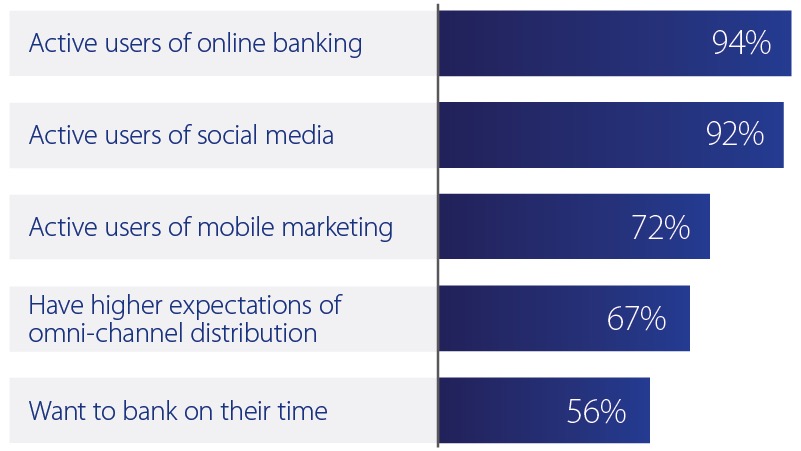

Millennials rely heavily on digital channels. More than 90 percent are active users of online banking, and they prefer to use digital channels to reach quick and easy resolutions to problems. To successfully attract and retain their business, offer high-quality customer service with emphasis on digital channels and self-serve capabilities.

Digital behavior and preferences1

Using digital and social channels to deliver customer service

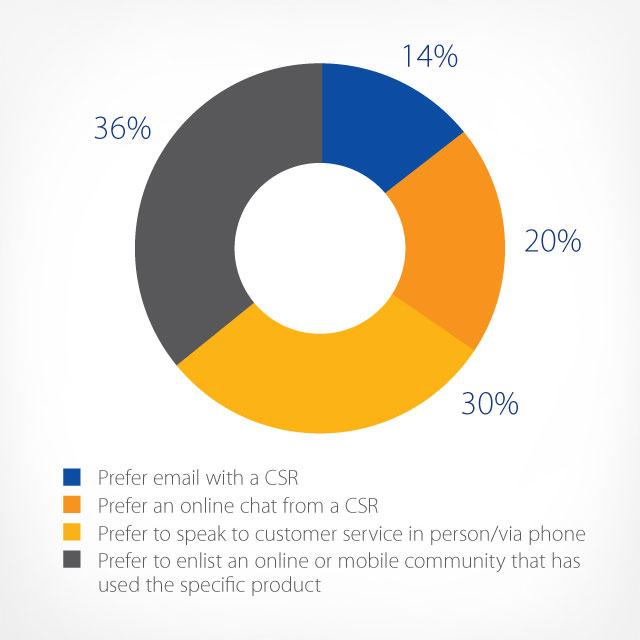

Customer service channels

Millennials prefer to email or chat with a customer service representative instead of speaking live. They reach out to others who have experience with the same product, via online and mobile communities, to help solve problems2.

This behavior has contributed to the rise of "social care"–the act of responding to customer care needs via social media, which has exhibited 68 percent growth from 2012-20143. Social care can be a very cost-effective practice; it costs as little as $1 to solve a customer issue on social media, which is nearly one-sixth that of many call-center interactions.

Meeting high service standards

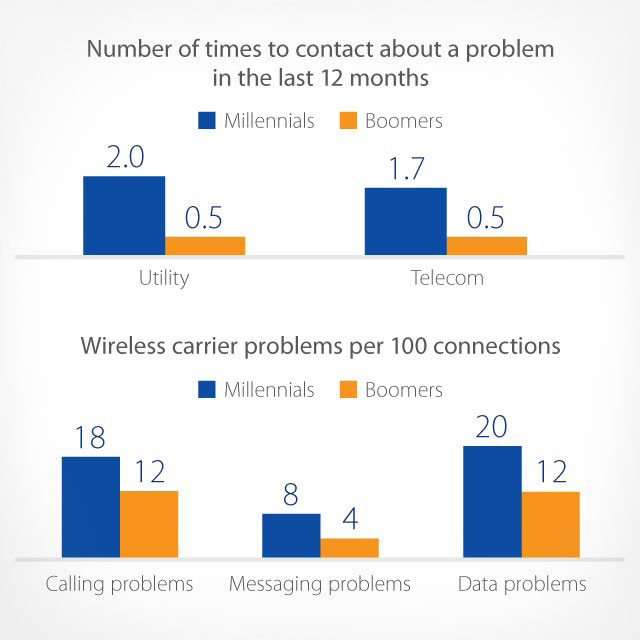

In addition to the desire to self-serve via digital channels, millennials have higher service standards and a heightened sensitivity to negative service experiences. In fact, millennials are more likely than Baby Boomers to report problems with service, as illustrated by data from the telecom industry4.

How many times customers contacted service providers about a problem

This is critically important to issuers as high expectations and low tolerance for service issues translates into potential retention risks. Millennials don’t hesitate to switch if they experience poor service; nearly half have stopped doing business with at least one company in the past year due to poor customer service5.

Top brands embrace omnichannel customer experience

Millennials are also multitaskers who are likely to use multiple channels to interact with a single company. Retailers like Amazon and Nordstrom have set the bar high for frictionless omnichannel experiences6.

As such, banks should provide omnichannel service, or a multi-channel approach to sales that offers a seamless shopping experience, regardless of shopping channel.

| Rank | Retailer |

|---|---|

|

1 |

Amazon.com |

|

2 |

Victoria's Secret |

|

3 |

Best Buy |

|

4 |

Nordstrom |

|

5 |

Macy's |

Source: Prosper Insights + Analytics

- Customer experience is a single type of touch point

- Traditional branch

- Online-only bank

- Different customer experience

- Differentiated products

- Siloed business units

- Knowledge and operations exist in functional siloes

- Brand dilution

- Single brand

- Some "channel-agnostic" services

- Some product synergies

- Separate processes for onboarding + transactional activities

- Customers experience the brand, not the channel

- One organization services all channels

- Flexibility and seamless acess to all products + services

- Full product offering across all channels

- Better use of analytics and channel preferences

Source: TheAmericanGenius.com

References

1 Accenture 2014 North America Consumer Digital Banking Survey, base consumers age 18-29.

2 Aspect Software Survey.

3 Social care in the world of "now," McKinsey & Company, July 2015.

4 J.D. Power, Millennials: A Customer Experience Perspective Webinar, April 2016.

5 North America Consumer Digital Banking Survey, The Digital Disruption in Banking, Accenture (May 2014).

6 Prosper Insights + Analytics.